Modern data center networks form the backbone of the digital economy, enabling the delivery of cloud services, big data analytics, artificial intelligence, and high-performance computing applications. These complex systems connect thousands of servers, storage devices, and networking equipment to facilitate efficient data transfer and resource sharing.What's dci?.

As global data generation continues to explode—projected to reach 181 zettabytes by 2025—the demands placed on data center networks have grown exponentially. This growth necessitates continuous innovation in network architecture, with particular emphasis on bandwidth, latency, energy efficiency, and scalability.

Traditional electrical interconnects are increasingly struggling to meet these demands, creating a critical need for advanced optical solutions. The Data Center Interconnect paradigm has evolved to address these challenges, enabling seamless communication between geographically distributed data centers while maintaining performance and reliability.

Today's data center networks must support not only unprecedented data volumes but also diverse workloads with varying requirements—from latency-sensitive real-time applications to bandwidth-intensive large-scale data processing tasks.

Evolution of Data Center Network Capacity

Annual growth in data center traffic and projected requirements through 2030

Introduction to Optical Interconnects within Data Centers

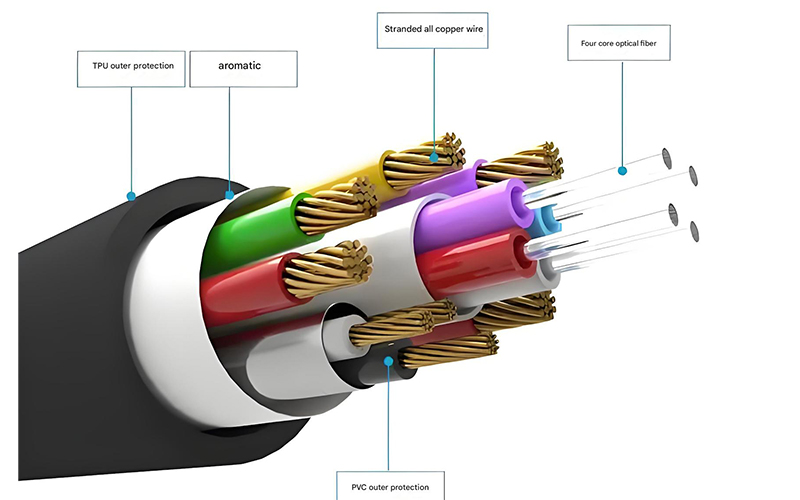

Optical interconnects utilize light signals to transmit data, offering significant advantages over traditional copper-based solutions in terms of bandwidth, distance, power consumption, and immunity to electromagnetic interference. Within data centers, these technologies have evolved from being primarily used for long-haul connections to becoming essential components at all levels of the network hierarchy.

The adoption of optical interconnects within data centers has followed a clear trajectory, starting with rack-to-rack connections, progressing to row-to-row, and now increasingly being deployed at the server-to-top-of-rack (ToR) switch level. This migration is driven by the relentless demand for higher data rates—from 10Gbps to 40Gbps, 100Gbps, and beyond.

Key optical technologies employed in data centers include vertical-cavity surface-emitting lasers (VCSELs), silicon photonics, wavelength-division multiplexing (WDM), and coherent optical transmission. These technologies form the foundation of modern Data Center Interconnect solutions, enabling efficient scaling of data center networks while managing power consumption and thermal challenges.

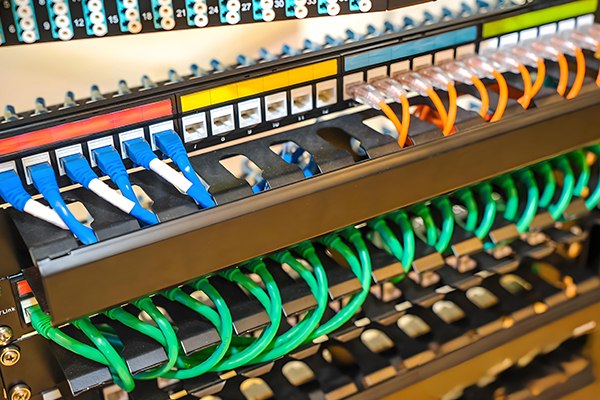

Fiber Optic Infrastructure

High-density fiber optic cabling provides the physical layer for optical interconnects

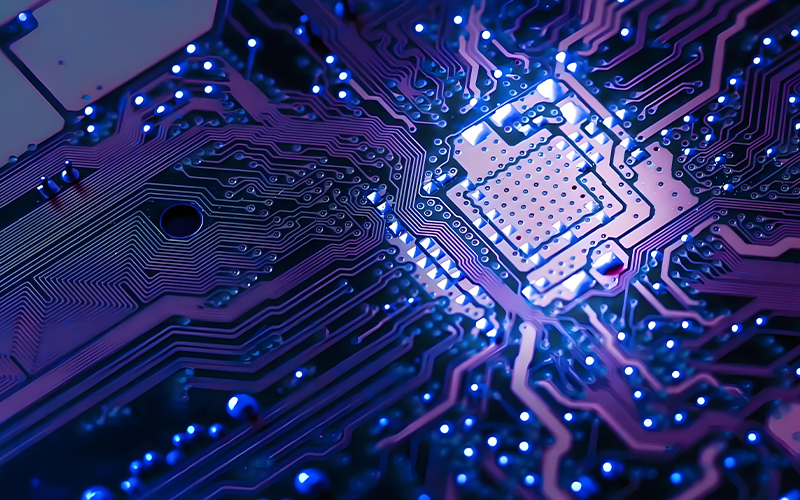

Optical Transceivers

Advanced transceivers convert electrical signals to optical and vice versa

Optical Interconnects in Data Center Networks

The role of optical technologies in modern data center networks has evolved from niche applications to fundamental building blocks, enabling the performance and scalability required by today's digital services.Define dci.

High Bandwidth

Optical interconnects support terabits per second data rates, far exceeding the capabilities of electrical alternatives.

Low Latency

Light-based transmission minimizes signal delay, critical for real-time applications and cloud services.

Energy Efficiency

Optical solutions consume significantly less power per bit transmitted compared to electrical interconnects.

Optical Interconnects for Scale-out Data Centers

Scale-out data centers, characterized by large numbers of commodity servers connected in flattened network topologies, have become the dominant architecture for cloud computing and web services. These environments require interconnect solutions that can efficiently scale with the number of servers while maintaining low latency and high bandwidth.

Optical interconnects play a pivotal role in enabling the scale-out model by providing the necessary bandwidth density and energy efficiency. Traditional three-tier architectures are being replaced with more flexible topologies such as leaf-spine and mesh networks, where optical technologies reduce the cabling complexity and improve overall network performance.

The Data Center Interconnect approach for scale-out environments emphasizes modularity and incremental expansion, allowing data center operators to add capacity as needed without complete network overhauls. This scalability is further enhanced by advances in pluggable optical transceivers, which enable easy upgrades to higher data rates as requirements evolve.

Leaf-Spine Architecture with Optical Interconnects

- Non-blocking connectivity between leaf and spine switches using optical links

- Consistent low-latency paths between any two servers in the data center

- Simplified scaling through addition of spine switches and optical links

- Reduced cable management complexity with high-density optical solutions

- Improved energy efficiency compared to traditional three-tier architectures

Next-generation Data Center Optical Interconnect Networks: End-to-end Perspective

Next-generation data center optical interconnect networks must be viewed from an end-to-end perspective, encompassing all layers from the physical optical transmission to higher-level network protocols and management systems. This holistic approach ensures that the entire system is optimized for performance, reliability, and cost-effectiveness.

From the end-to-end viewpoint, future optical interconnect networks will integrate advanced technologies such as software-defined networking (SDN), network function virtualization (NFV), and artificial intelligence for network management. These technologies will work in concert with novel optical transmission techniques to create highly adaptive, self-optimizing networks.

The Data Center Interconnect ecosystem of the future will span from on-chip photonics at the server level to long-haul optical links between geographically distributed data centers. This end-to-end optical path will minimize latency through signal regeneration reduction and enable unprecedented data rates through coherent transmission and advanced modulation formats.

End-to-end Optical Network Layers

On-chip Photonics

Optical connections directly on server and switch chips

Server-level Optics

Optical transceivers at the server interface

Rack & Row Interconnects

Optical links between racks and data center sections

Data Center Interconnect

Long-haul optical connections between facilities

Control & Management

Software-defined control plane for the entire optical network

Simulation and Performance Analysis of Data and Load Intensive Cloud Computing Data Centers

The design and optimization of modern data centers, particularly those handling data and load-intensive cloud computing workloads, rely heavily on advanced simulation and performance analysis techniques. These methodologies enable researchers and engineers to evaluate new architectures and technologies without the need for expensive physical prototypes.

Simulation frameworks for data center networks must accurately model various components, including servers, switches, optical transceivers, fiber links, and traffic patterns. Advanced models incorporate physical layer characteristics such as signal attenuation, dispersion, and noise, which are critical for evaluating optical interconnect performance.

Performance analysis of Data Center Interconnect systems involves evaluating key metrics such as throughput, latency, jitter, energy consumption, and fault tolerance under various load conditions. These analyses help identify bottlenecks and optimize network design for specific workloads, whether they be high-performance computing, big data analytics, or real-time cloud services.

Performance Metrics Comparison

Optical vs. Electrical Interconnects in Load-Intensive Scenarios

Key Simulation Tools

OMNeT++ with INET

Network simulation with optical extensions

NS-3

Discrete-event network simulator

OptSim

Optical communication system simulator

CloudSim

Cloud computing simulation environment

Optical Interconnect Architectures

Advanced optical interconnect architectures are reshaping the future of data center networking—by enhancing critical data center connectivity—enabling unprecedented performance while addressing key challenges in scalability and energy efficiency.

Photonics Applications in Future Data Center Networks

Photonics—the science and technology of generating, controlling, and detecting light—has numerous applications in future data center networks that will transform how data is transmitted and processed. These applications range from fundamental physical layer components to sophisticated network architectures.

One of the most promising areas is silicon photonics, which integrates optical components directly onto silicon chips, enabling high-bandwidth, low-power communication between chips within servers and between servers and switches. This technology leverages existing semiconductor manufacturing processes, promising cost-effective mass production.

Other key photonics applications include wavelength-division multiplexing (WDM) for increasing link capacity, photonic integrated circuits (PICs) for compact, high-performance optical components, and optical switching for reducing latency in Data Center Interconnect systems. These technologies collectively enable the transition from electrical to optical domains at progressively lower levels of the network hierarchy.

Key Photonics Technologies

Silicon Photonics

Integrating optical functionality on silicon substrates for high-volume manufacturing

Wavelength-Division Multiplexing

Transmitting multiple data streams simultaneously over a single fiber using different wavelengths

Optical Switching

Direct light-based switching without electrical conversion for ultra-low latency

Vertical-Cavity Surface-Emitting Lasers

Compact, low-cost lasers ideal for short-reach data center applications

Coherent Optical Transmission

Advanced modulation techniques for high-capacity Data Center Interconnect links

All-Optical Networks: A System Perspective

All-optical networks represent the ultimate evolution of data center networking, where data remains in the optical domain from source to destination without intermediate electrical conversions. This approach eliminates the bottlenecks associated with electro-optical and opto-electrical conversions, enabling unprecedented bandwidth and latency performance.

From a system perspective, all-optical networks require a holistic design that encompasses optical transmitters, amplifiers, switches, modulators, and receivers working in concert. Key challenges include maintaining signal integrity over optical paths, managing wavelength resources efficiently, and implementing robust control mechanisms for network configuration and fault tolerance.

All-optical Data Center Interconnect systems offer significant advantages for large-scale, geographically distributed data center architectures, enabling seamless data migration and workload balancing across locations with minimal latency penalty. These systems also promise substantial energy savings by eliminating the power-hungry electrical components used in traditional networks.

Benefits of All-Optical Network Systems

Unlimited Bandwidth Potential

Leveraging the enormous bandwidth of the optical spectrum

Ultra-low Latency

Elimination of electro-optical conversion delays

Reduced Power Consumption

Lower energy requirements compared to electrical networks

Simplified Scalability

Easier capacity upgrades through wavelength addition

Improved Reliability

Fewer components mean fewer potential failure points

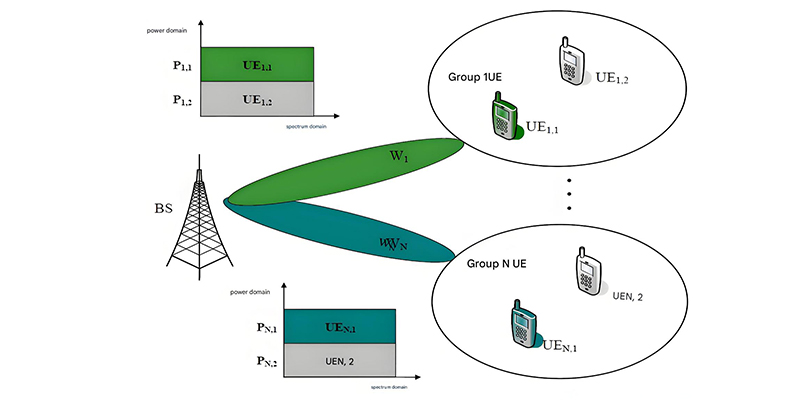

A Flexible Data Center Network Based on High-Speed MIMO OFDM

High-speed Multiple-Input Multiple-Output (MIMO) Orthogonal Frequency-Division Multiplexing (OFDM) technologies are emerging as promising solutions for flexible, high-capacity data center networks. This combination leverages the strengths of both techniques to overcome key limitations in traditional optical interconnects.

MIMO technology uses multiple transmitters and receivers to simultaneously transmit multiple data streams over the same physical medium, effectively increasing bandwidth without requiring additional fiber. OFDM divides the transmission bandwidth into multiple orthogonal subcarriers, each carrying a portion of the data, which improves spectral efficiency and robustness against signal impairments.

In Data Center Interconnect applications, MIMO OFDM enables dynamic bandwidth allocation, allowing network resources to be flexibly assigned based on traffic demands. This flexibility is particularly valuable in cloud computing environments where workloads can vary significantly over time. Additionally, the adaptive nature of MIMO OFDM systems allows them to optimize performance based on channel conditions, ensuring reliable operation even in challenging optical environments.

MIMO OFDM System Architecture

Key Advantages for Data Centers

- Dynamic bandwidth allocation matching traffic demands

- Improved spectral efficiency enabling higher data rates

- Robustness against optical channel impairments

- Simplified migration path from existing 100G/400G systems

- Support for heterogeneous traffic types with different QoS requirements

- Enables cost-effective upgrades to Terabit Data Center Interconnect links

Petabit Bufferless Optical Switching for Data Center Networks

Petabit bufferless optical switching represents a revolutionary approach to data center networking, enabling unprecedented data rates while eliminating the latency and energy consumption associated with electronic buffers. These switches operate entirely in the optical domain, routing data based on wavelength, polarization, or spatial mode without converting signals to electricity.

Bufferless designs eliminate the need for large electronic buffers that store data during congestion, which are significant sources of latency and power consumption in traditional switches. Instead, these systems use advanced contention resolution techniques such as wavelength conversion, deflection routing, and time-domain scheduling to manage traffic without buffering.

The petabit capacity of these switches—capable of handling trillions of bits per second—addresses the growing bandwidth demands of next-generation data centers and Data Center Interconnect systems. By combining this extraordinary capacity with bufferless operation, these switches enable ultra-low latency communication essential for emerging applications such as real-time AI inference, high-frequency trading, and distributed big data analytics.

Petabit Switch Performance Characteristics

Optical Interconnects in High-Performance Data Centers

High-performance data centers—supporting supercomputers, AI training clusters, and high-performance computing (HPC) applications—have unique requirements that make optical interconnects indispensable. These environments demand not just high bandwidth but also low and predictable latency, high reliability, and efficient scaling for thousands of nodes.

In high-performance data centers, optical interconnects are deployed at multiple levels: between processors within a node, between nodes in a rack, between racks in a cluster, and for Data Center Interconnect links connecting geographically distributed HPC facilities. This end-to-end optical approach minimizes latency and maximizes bandwidth, enabling the tightly coupled parallel computing required for complex simulations and AI model training.

Emerging high-performance data center architectures increasingly adopt dragonfly and torus topologies interconnected with optical links, providing high bisection bandwidth and fault tolerance. These networks leverage wavelength routing and optical circuit switching for large, steady-state data transfers, while maintaining packet switching capabilities for smaller, more dynamic communication patterns. The result is a hybrid optical-electrical network optimized for the diverse traffic patterns found in high-performance computing workloads.

High-Performance Data Center Interconnect Hierarchy

Application Areas Benefiting Most

AI/ML Training Clusters

Requires high bandwidth between GPU nodes

Climate & Weather Simulation

Demands low-latency communication between nodes

Computational Genomics

Needs high-throughput data transfer capabilities

Quantum Computing

Requires precise timing and low noise

Research and Publications

Explore our latest research papers and publications on optical interconnects for future data center networks.

Silicon Photonics for Next-Generation Data Centers

A comprehensive review of silicon photonics technologies and their applications in modern data center networks.

1.6Tbps Optical Transceivers for Data Center Interconnect

Novel transceiver designs enabling terabit per second data rates for next-generation Data Center Interconnect applications.

All-Optical Switching Architectures for HPC Data Centers

Analysis of all-optical switching technologies and their impact on high-performance computing data center performance.

Get in Touch

Interested in our research on optical interconnects for future data center networks? Contact our team of experts to discuss potential collaborations or learn more about our work.

Location

Network Research Lab, 123 Innovation Drive, Tech Park, CA 94043

optics@datacenter-research.org

Phone

+1 (555) 123-4567